FTSE / DAX Still Weak Moving Into End of Year

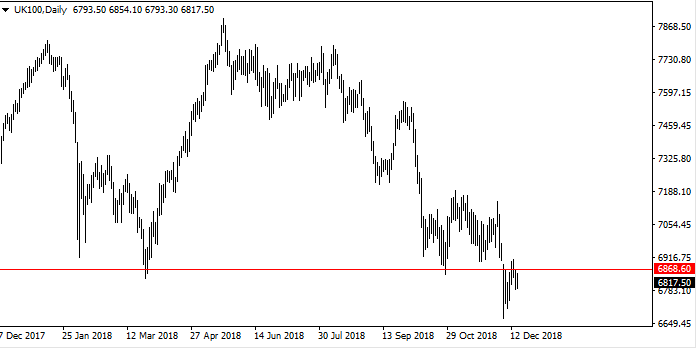

Shares in the UK and Europe are still languishing near their year lows, as the often strong time of year for the markets arrives, and nearly passes. The FTSE 100 made a clean break of the support in early December, under 6850 and has since not shown any real strength to suggest it will attempt to make back the loss.

Similar patterns are apparent over on the DAX30 index too. Early December saw the German market break down under 11000 and currently looks weak below it.

Why Are Shares So Weak?

There are many reasons that can be attached to the weakness in stocks. We have the uncertainty of Brexit, which I will spare you from more details (I’m sure you are sick of it all by now) and there’s the on-going “trade war” between Donald Trump and China. With China being a huge market for many companies, especially for metal exports, it’s not surprising investors are wary. A further slowdown of China’s economy is the highly likely over the coming quarters, and the markets could be pricing this fact in.

For those in the UK, again Brexit worries are pushing the British Pound back towards the lows of 2016. Every rise is being met by further lows, nobody is in the mood to buy GBP. Which is no surprise given the prospects of volatility that may occur between now and March 2019 when (IF) the UK is set to leave the European Union.

Uncertainty is always a catalyst for lower prices, whichever market it is. There’s a lot of uncertainty right now, in the USA, in the UK, in Europe and also in Asia. The whole thing feels like it’s on a knife edge, waiting for something (anything) to rescue it.

It could go either way. Some bad news could trigger more sell offs (likely). However, some good news which clears uncertainty could see a sharp rise on relief of the situation.

Which way are you placing your bets?

About Pete Southern

Pete Southern is an active trader, chartist and writer for market blogs. He is currently technical analysis contributor and admin at this here blog.

Most Popular Content

- Pound Holds Strong as Labour Wins with a Landslide

- Crude Oil Prices Rally as Inventory Declines and Rate Cut Hopes Emerge

- Strength in Gold and Copper Continues – But for How Long?

- Weak Payroll Data Sends Stocks Higher

- Gold Flying and Making New All Time Highs

- Gold Prices Slip Ahead of Anticipated Economic Data

- Oil Prices Surge From Lows Amid Mixed Global Signals

- U.S. Stock Indices: A Dance Between Optimism and Fear

Currency Articles - Jul 7, 2024 13:40 - 0 Comments

Pound Holds Strong as Labour Wins with a Landslide

More In Currency Articles

- The Pound is in Freefall – When Will It Stop?

- GBP Gets Ready for an Unpredictable Day with Meaningful Vote 2