If you project forward then act forward

Well as we all knew it would happen, we should sit back and smile at Mr King, Mr Brown and the other one who escapes me, oh yes Darling:

as they try and extricate themselves from the forlorn promises and the hype they pour upon the publics head, even as the prols find they can’t afford to eat cake, let alone bread.

Still we have time so let’s have a look at the details of letter:

Oh, you thought I mean’t the King letter? No, this sycophantic note from Darling is much more illuminating as to the state of the Governments mindset:

Its truly awful, the man is incapable of disagreeing with the Bank of England because he is too scared to tell the public what the real cure for this problem is and the effect it will have. Let me spell it out. Inflation is the by-product of too much cash and credit chasing too few goods. If you want to cure inflation, lower the amount of credit and cash in an economy. It’s not even a global thing, if Sterling appreciates as it becomes scarcer then the cost of goods priced in other currencies, including the US dollar drops. The Pound buys more per unit and will continue to strengthen as the amount of sterling denominated cash and credit diminishes.

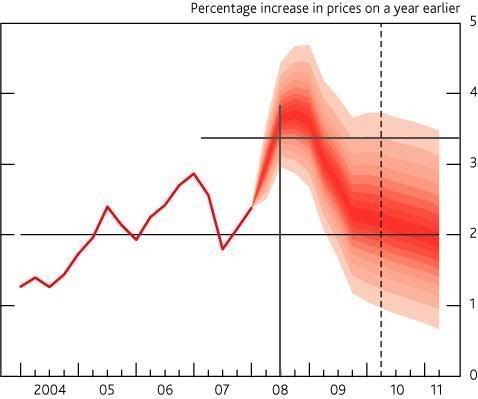

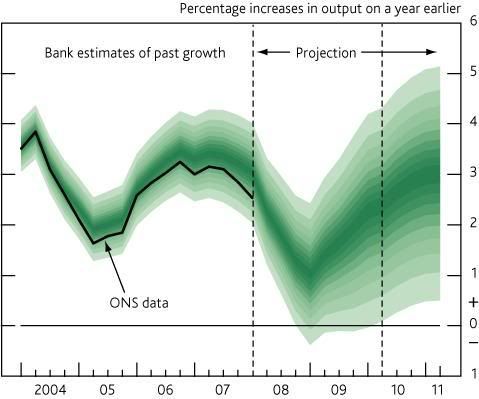

The downside? Well, consumers cannot borrow / use excess earnings with the abandon of yesteryear, spending drops as savings become the new “bubble”. As the consumer slows, all those businesses that rely on constantly expanding revenue to pay increasing levels of debt servicing begin to struggle. They either drop prices to encourage consumer interest or they stop producing goods and services at unprofitable margins. Either way many will not survive as they exsist now, thanks to their keynesian based business models. Yet even when the Bank of England predicts such an event:

no one in authority will tell the public what is coming. Why? Purely and simply, they do not want consumers to stop spending, even if it’s against the public interest. They will sit in their plush surroundings, pampered and fawned upon as they hope and pray that “something” will happen to change the outlook. Look closely at the 2 charts above, you know I like relationships and especially when relationships break down. The projections disagree with the previous relationship. We are to believe that GDP will rise back to and beyond previous peaks after inflation turns down and heads for the floor? Why do they think inflation will go that way? Do they truly believe it will “just happen”? GDP rose when inflation rose, they are interconnected. The last time inflation was stuck around 1% GDP dropped. Only the Bank of Englands increase in money supply goosed GDP up. Now they project it will be different next time?

So as we descend into the pit, the abyss that is the deflationary end to this sorry story, the powers that be will sit back in amazement as yet again the consumers, the public, the voters allow themselves to be sacrificed to save the elite. As was once said about the troops and officers in the First World War, the troops were like lions, led into battle by donkeys. So while Brown, King and Darling bray away to each other across Whitehall, feel afraid about the direction they are leading you.

Ignore the braying donkeys, stop spending and start saving, lock in some high rates and whatever you do, get your own map.

Excuse the spelling mistakes, I’m long on rant and short patience tonight.

Commentary by Mick Phoenix

on behalf of CA Letters

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. The views in the article are for informational purpose only.

About Pete Southern

Pete Southern is an active trader, chartist and writer for market blogs. He is currently technical analysis contributor and admin at this here blog.

Most Popular Content

- Weak Payroll Data Sends Stocks Higher

- Gold Flying and Making New All Time Highs

- Gold Prices Slip Ahead of Anticipated Economic Data

- Oil Prices Surge From Lows Amid Mixed Global Signals

- U.S. Stock Indices: A Dance Between Optimism and Fear

- Gold Prices Dance with CPI Data and the Fed

- Oil Prices Surge Amid Record Demand and Supply Tightening

- Gold Steady As US Dollar Index Tries to Make Gains

Currency Articles - May 22, 2019 15:21 - 0 Comments

The Pound is in Freefall – When Will It Stop?

More In Currency Articles

- GBP Gets Ready for an Unpredictable Day with Meaningful Vote 2

- British Pound Stays Strong Whilst The Dollar Remains Weak

Gold and Oil News - Mar 30, 2024 10:37 - 0 Comments

Gold Flying and Making New All Time Highs

More In Gold and Oil News

- Gold Prices Slip Ahead of Anticipated Economic Data

- Oil Prices Surge From Lows Amid Mixed Global Signals