FTSE 100 and Dow Jones: Can They Head Higher This Year?

Indices in the UK and USA have been on a phenomenal run since the early February, a rise that accelerated with post Brexit relief. Whilst the FTSE 100 stumbled its way up slowly in anticipation of the Brexit vote, the Dow Jones Industrial Average has been strong all the way through, really strong. So much so that it’s now standing at all-time highs above 18400.

But what is next for these blue chip indices? Can this strength continue, or will it all end in tears?

FTSE 100 Index

Banks are still lagging somewhat. And so are home builders, since being hit with uncertainty of Brexit. Although they’ve recovered slightly from those lows, there’s still room for more in the main players. Barclays share price remains under £2, Lloyds share price remains under 60p. If banks can begin to shed some of the negative sentiment that Brexit brought them, this could help push the FTSE 100 higher into winter.

The chart below shows the breakout point of the early 2016 high and subsequent rise to a touch underneath 7000. Will it push multi-year highs like its US cousin? Probably, but only if banking stocks and home builders begin to pull their weight again.

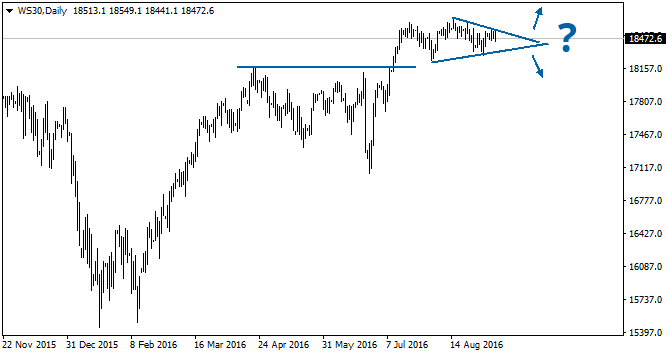

Dow Jones Index

Stocks in the Dow Jones are flying, it’s fair to say. Bank of America has put on near to 50% this year alone. The Home Depot printed a new all-time high, as did General Electric Company. Whilst Apple has stuttered compared to previous years, other tech stocks like Microsoft Corporation have been in a strong upward trend.

In the chart below you can see (like the FTSE 100) a breakout of early 2016 high into a small wedge like pattern which seems to be consolidating at new all-time highs.

Will it push higher? This is a tricky question. Its election year in the USA, and there’s no hiding from the fact that if Trump gets into the White House, this will bring uncertainty. The US markets are usually strong running into elections, which seems to be the pattern right now, whether this will continue post-election is the million dollar question.

One thing to watch: If Trump wins the election there will most likely be a rush of money into Gold from Stocks. Keep an eye on Gold as we approach the election, it may give some clues as to which way traders are placing their bets.

About Pete Southern

Pete Southern is an active trader, chartist and writer for market blogs. He is currently technical analysis contributor and admin at this here blog.

Most Popular Content

- Silver’s Getting Loud, Gold’s Ready to Get Started

- Copper Finds Its Footing as Market Sentiment Improves

- S&P 500 Grinds Higher as Rate Cut Hopes Simmer

- Bitcoin Holds Near $120K as 401(k) Buzz Meets Inflation Jitters

- Pound Climbs on BoE Cut and Dovish Signals

- Gold Soars on Tariff Shock as Copper Holds Steady

- Markets Wobble After Highs as Fed Holds Steady and Earnings Send Mixed Signals

- Copper Prices Drift in the Wake of a Surprise Tariff Shock

Currency Articles - Aug 13, 2025 1:07 - 0 Comments

Bitcoin Holds Near $120K as 401(k) Buzz Meets Inflation Jitters

More In Currency Articles

Gold and Oil News - Sep 21, 2025 10:31 - 0 Comments

Silver’s Getting Loud, Gold’s Ready to Get Started

More In Gold and Oil News

- Gold Soars on Tariff Shock as Copper Holds Steady

- Copper Prices Drift in the Wake of a Surprise Tariff Shock