Gold Price – To Buy Or Not To Buy?

As things stand, Gold prices have bounced (since Monday) from the lows of the last two years. The question remains, to buy or not to buy? With the US Dollar on a rampage, it’s easy to find reasons to be uncertain on Gold, however, does this bounce show us where support in the price remains?

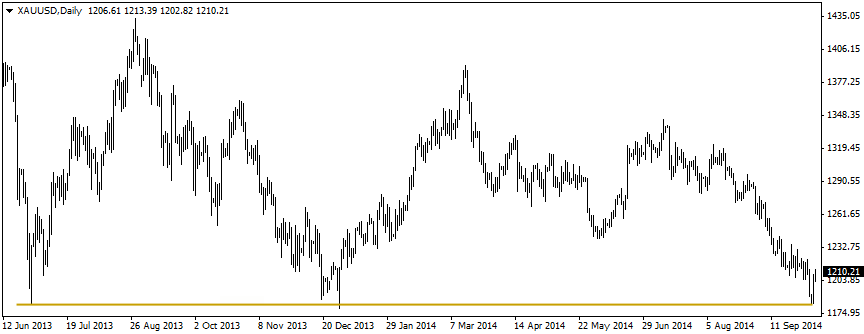

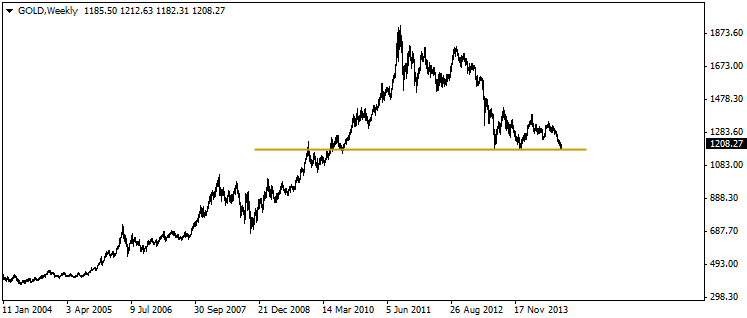

As you see above in the chart, the lows here have been tested (now) three times since mid 2013. Often a few good tests of a support area are needed to see if traders see value at that level. As it happens these are not the only times the level has been tested. Take a look below at the weekly chart for Gold, and specifically the area in late 2009, when the price broke through this level of resistance, and then retested it from above, before continuing the trend up to the highs.

In my opinion the recent falls in Gold prices to these levels are completely down to the movements of the US Dollar. If you haven’t been following, the Dollar is on a roll at the moment. Since August it has been pushing higher, and can you guess what? It is now right up there, near the levels it was at during the bullish break-through in 2009.

So you say Gold is about to go higher? Maybe, maybe not. If it is to go higher, the stock market needs to react to the surge in US Dollars. Right now it’s not. But any hint of movements from the Fed on interest rate hikes or loosening of monetary policies, may see that change, and change quickly.

Any sharp shock to the markets whilst the US Dollar is strong will most likely see a sustained sell off in stocks. That money will usually flow right into Gold, in huge volume.

So, to buy or not to buy?

I’d say wait, but keep a very close eye on the way things pan out over the coming month in Gold.

About Pete Southern

Pete Southern is an active trader, chartist and writer for market blogs. He is currently technical analysis contributor and admin at this here blog.

Most Popular Content

- Silver’s Getting Loud, Gold’s Ready to Get Started

- Copper Finds Its Footing as Market Sentiment Improves

- S&P 500 Grinds Higher as Rate Cut Hopes Simmer

- Bitcoin Holds Near $120K as 401(k) Buzz Meets Inflation Jitters

- Pound Climbs on BoE Cut and Dovish Signals

- Gold Soars on Tariff Shock as Copper Holds Steady

- Markets Wobble After Highs as Fed Holds Steady and Earnings Send Mixed Signals

- Copper Prices Drift in the Wake of a Surprise Tariff Shock

Currency Articles - Aug 13, 2025 1:07 - 0 Comments

Bitcoin Holds Near $120K as 401(k) Buzz Meets Inflation Jitters

More In Currency Articles

Gold and Oil News - Sep 21, 2025 10:31 - 0 Comments

Silver’s Getting Loud, Gold’s Ready to Get Started

More In Gold and Oil News

- Gold Soars on Tariff Shock as Copper Holds Steady

- Copper Prices Drift in the Wake of a Surprise Tariff Shock