Gold Falls But Higher Prices May Be On The Horizon

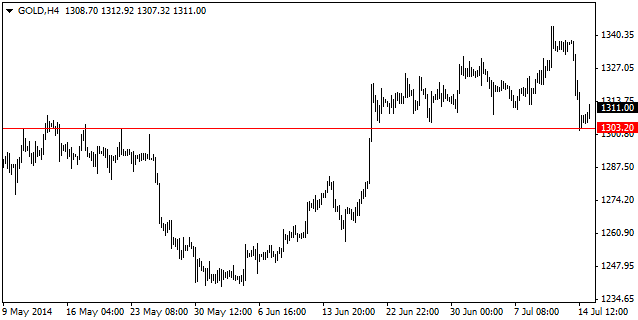

Gold prices fell sharply yesterday (Monday 14th) as a stop triggering run plunged the shiny stuff back to the top of the mid June spike. A general boom on the stock market has been chosen as the catalyst by many analysts, but as we well know, Gold is a beast for spiking and running those stops, and most likely won’t go higher (or lower) until it takes out weaker positions.

History repeats itself efficiently, and a study of any historical chart in a 4 hour timeframe will clearly show you the sharp spikes in either direction on Gold prices before any move happens.

This fall has (so far) held above the April and May highs, possibly testing them for support and value. If there are buyers at these levels, then we could see Gold start to rise once again over the coming weeks. But don’t bet your house on it. Geo-political situations are a big driving factor in this price.

There is currently increasing concern on escalation of conflict in Iraq, Ukraine, Syria and now Israel. It will only take one of these situations to explode, and Gold will do so too. However, in reverse, an agreement to stop fighting in Israel or any other area could also see investors become less nervy of stocks around these highs, and Gold may consolidate more.

Looking at the chart, we can see the resistance it is now testing for support. Gold bulls will be looking for this line to hold. A fall beyond this may trigger further stop runs down to the $1270 area, which was in range during mid-May.

For any Fibonacci chartists, this spike down has paused exactly at the 32% fib retrace taken from the May low to the July high. Often the 50% or 61% Fibonacci levels are more significant, however in strong trends a pullback to the 32% can often be bought into.

The coming days should see what will be the next move. If Gold prices can start to climb again, after shaking out weaker longs, there may be more money to play with higher up.

About Pete Southern

Pete Southern is an active trader, chartist and writer for market blogs. He is currently technical analysis contributor and admin at this here blog.

Most Popular Content

- Dow Jones and US Stocks Take a Breather as Inflation Cools and Trade Talks Reignite

- Crude Oil Prices Keep Sliding as Opec Floods Market

- Gold and Copper Prices Dip Amid Trade Turbulence and Tariff Worries

- Copper Prices Hit New Heights Amid Global Trade Tensions

- Oil Markets Respond to OPEC+ Production Signals as Prices Find Support

- Gold Prices Reach Record Highs Amid Economic Uncertainty and Volatility

- Pressure Mounts on the British Pound Following Autumn Budget

- Impact and Outlook for the U.S. Economy on Rate Cut

Currency Articles - Nov 3, 2024 13:35 - 0 Comments

Pressure Mounts on the British Pound Following Autumn Budget

More In Currency Articles

Gold and Oil News - May 5, 2025 13:10 - 0 Comments

Crude Oil Prices Keep Sliding as Opec Floods Market

More In Gold and Oil News

- Gold and Copper Prices Dip Amid Trade Turbulence and Tariff Worries

- Copper Prices Hit New Heights Amid Global Trade Tensions

LiveWire Economics Blog, Shares and Markets - Jun 11, 2025 21:37 - 0 Comments

Dow Jones and US Stocks Take a Breather as Inflation Cools and Trade Talks Reignite

More In Shares and Markets

- US Stock Market Faces Turbulence and Mixed Commodity Reactions

- U.S. Stock Indices: A Dance Between Optimism and Fear